What are the investments for a stone crusher

Time:16 September 2025

Investing in a stone crusher involves a comprehensive understanding of the industry, equipment, operational costs, and market dynamics. This article provides a detailed overview of the various investments required for setting up and operating a stone crusher.

Initial Capital Investment

The initial capital investment is crucial for setting up a stone crusher. This includes the cost of purchasing equipment, land, and other necessary infrastructure. Key components of initial investment are:

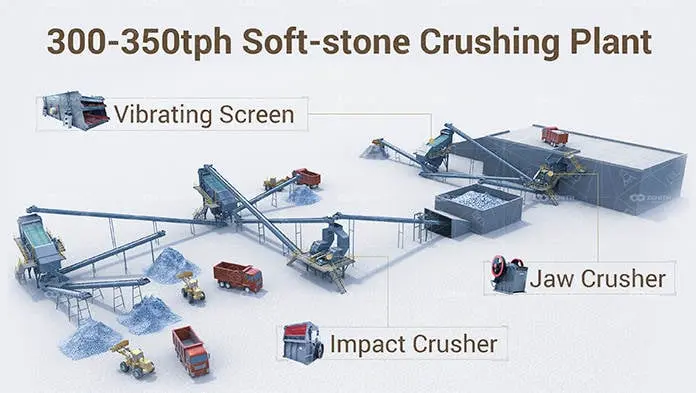

Equipment Costs

- Primary Crusher: Essential for breaking down large stones into smaller pieces.

- Secondary Crusher: Used for further processing of materials.

- Conveyors: For transporting materials between different stages of processing.

- Screening Equipment: To sort materials by size.

- Dust Suppression Systems: To minimize environmental impact.

Land and Infrastructure

- Land Acquisition: The cost of purchasing or leasing land for the stone crusher.

- Infrastructure Development: Building facilities such as offices, storage areas, and maintenance workshops.

Licensing and Permits

- Environmental Permits: Required to ensure compliance with environmental regulations.

- Operational Licenses: Necessary for legally operating the stone crusher.

Operational Costs

Operational costs are ongoing expenses incurred during the functioning of a stone crusher. These include:

Labor Costs

- Skilled Labor: Hiring experienced operators and technicians.

- Unskilled Labor: Workers for manual tasks and maintenance.

Maintenance and Repairs

- Routine Maintenance: Regular upkeep of equipment to ensure efficient operation.

- Repairs: Addressing unexpected breakdowns and wear-and-tear.

Utilities and Consumables

- Electricity: Powering machinery and equipment.

- Fuel: For vehicles and machinery.

- Water: Used in dust suppression and cooling systems.

Marketing and Sales Investment

To ensure profitability, investment in marketing and sales is essential. This includes:

Market Research

- Competitor Analysis: Understanding the competitive landscape.

- Customer Needs Assessment: Identifying potential customers and their requirements.

Branding and Promotion

- Advertising: Promoting the stone crusher through various channels.

- Sales Team: Hiring professionals to manage customer relationships and drive sales.

Risk Management and Contingency Planning

Investing in risk management strategies is vital to mitigate potential challenges. This involves:

Insurance

- Equipment Insurance: Protecting against damage or theft.

- Liability Insurance: Covering potential legal issues.

Contingency Funds

- Emergency Repairs: Allocating funds for unforeseen breakdowns.

- Market Fluctuations: Preparing for changes in demand or pricing.

Technological Investments

Adopting modern technology can improve efficiency and reduce costs. Consider investing in:

Automation

- Automated Systems: Enhancing productivity and reducing labor costs.

- Remote Monitoring: Tracking equipment performance and maintenance needs.

Software Solutions

- Inventory Management: Streamlining stock control and ordering processes.

- Customer Relationship Management (CRM): Managing interactions with clients.

Conclusion

Investing in a stone crusher requires careful consideration of various factors, including initial capital, operational costs, marketing, risk management, and technology. By understanding these components, investors can make informed decisions and optimize their returns in the stone crushing industry.