What Critical Metrics Should a Stone Crusher Plant Project Report Include for Investor ROI Analysis?

Tid:

21 February 2021

When preparing a stone crusher plant project report for investor ROI (Return on Investment) analysis, it is essential to include critical metrics and key financial, operational, and market-related data. These metrics provide investors with the necessary information to evaluate the project’s profitability, feasibility, and risk. Below are the primary metrics and details that should be included:

1. Financial Metrics

a. Capital Expenditure (CAPEX)

- Initial investment required for plant setup, machinery, land acquisition, infrastructure, etc.

- Include cost breakdown for different components (e.g., crusher machinery, conveyors, dust control systems).

b. Operating Costs (OPEX)

- Include recurring expenses such as labor, electricity, water, fuel, maintenance of machinery, and administrative costs.

c. Revenue Projections

- Expected revenue based on production capacity and market demand.

- Include pricing estimates for crushed stone (gravel, aggregates, etc.) per ton and sales volume.

d. Gross Profit Margin

- Profit margin based on revenue minus variable costs like materials, energy, and direct labor.

e. Net Profit Margin

- Profit after deducting all expenses (fixed and variable), including taxes and interest payments.

f. Break-Even Analysis

- Time period and volume required to recover the initial investment.

- Highlight the break-even tonnage and time frame.

g. Return on Investment (ROI)

- Demonstrate anticipated ROI as a percentage to showcase project profitability.

- Include calculations based on revenue projections and cost data.

2. Production Metrics

a. Produktion Kapacitet

- Amount of crushed stone the plant can produce annually or monthly (typically measured in tons).

b. Input Requirements

- Raw material supply availability (e.g., quality and quantity of stones from the quarry).

- Highlight transportation costs and logistics involved in obtaining raw materials.

c. Utilization Rate

- Expected operational efficiency and production output relative to the plant’s capacity.

3. Market Demand and Competition Analysis

a. Market Size

- Forecast demand for crushed stone in the target market or region (e.g., construction, infrastructure development projects).

b. Pricing Trends

- Current and projected price per ton of crushed stone in your market area.

- Factor in seasonal price fluctuations or changes due to economic policies.

c. Competitive Landscape

- Analysis of existing competitors: their capacity, market share, and pricing strategy.

d. Target Customers

- Key industries consuming crushed stone (e.g., builders, developers, contractors, road construction projects).

- Include contracts or letters of intent from potential customers if available.

e. Market Risks

- Risks such as changing regulations, environmental impact concerns, or shifts in demand due to economic downturns.

4. Operational Metrics

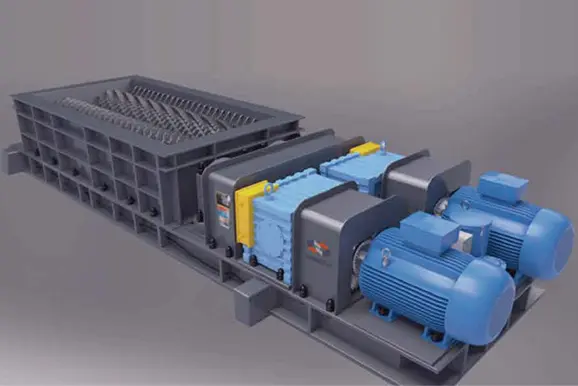

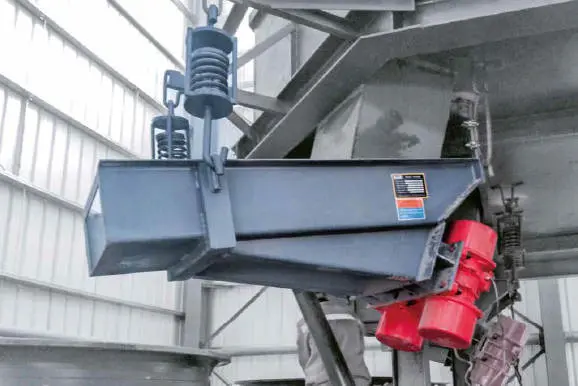

a. Technology and Machinery

- Detailed description of the type of machinery being used (e.g., jaw crusher, cone crusher, and screeners).

- Energy efficiency and automation capabilities.

b. Manpower Requirements

- Employee count and skill level required for plant operations.

c. Miljööverensstämmelse

- Include measures for dust suppression, noise control, and waste management.

- Outline compliance with local and national environmental laws.

d. Underhållskostnader

- Estimates for ongoing repairs, periodic maintenance, and equipment upgrades.

5. Risk Assessment

a. Operational Risks

- Potential risks such as equipment failure, labor shortages, or raw material supply disruptions.

b. Regulatory Risks

- Include compliance with zoning laws, mining permits, and environmental regulations.

c. Financial Risks

- Risk from changes in interest rates, inflation, or lender policies.

6. Economic Feasibility

a. Payback Period

- Timeline for recovering the initial investment based on projected cash inflows.

b. Net Present Value (NPV)

- Include the projected total value of cash flows discounted to today’s value.

c. Internal Rate of Return (IRR)

- Demonstrate the efficiency of the investment and compare it to industry benchmarks.

7. Growth and Expansion Potential

- Long-term opportunities for scaling production capacity.

- Future plans for diversification (e.g., additional stone products or entry into new markets).

8. Supporting Documents

Include relevant documents to back up your report:

- Environmental impact assessment (EIA) approval.

- Quarry lease agreements.

- Supplier agreements for machinery parts and maintenance services.

- Customer contracts or commitments.

By incorporating these critical metrics and analysis points in your project report, investors will have a detailed understanding of the expected cash flows, profitability, market potential, and long-term viability of your stone crusher plant project.

Contact Us

Shanghai Zenith Mineral Co., Ltd. is a leading manufacturer of crushing and grinding equipment in China. With more than 30 years of experience in the mining machinery industry, Zenith has built a strong reputation for delivering high-quality crushers, mills, sand-making machines, and mineral processing equipment to customers around the world.

Headquartered in Shanghai, China, Zenith integrates research, production, sales, and service, providing complete solutions for aggregates, mining, and mineral grinding industries. Its equipment is widely used in metallurgy, construction, chemical engineering, and environmental protection.

Committed to innovation and customer satisfaction, Shanghai Zenith continues to advance in intelligent manufacturing and green production, offering reliable equipment and comprehensive after-sales service to help clients achieve efficient and sustainable operations.

website: https://www.chinagrindingmill.net

E-post:info@chinagrindingmill.net

Whatsapp:+8613661969651